The following is the text of the Historic Places Aotearoa Submission to the Building Amendment Bill:

Patron: Dame Anne Salmond, DBR, FRSNZ, FBA

2013 New Zealander of the Year

25th October 2018

Ministry of Building, Innovation and the Employment

PO Box 1473,

Wellington 6140

Submission on

BUILDING AMENDMENT BILL

Introduction

This submission is made by Historic Places Aotearoa Inc. (HPA) which welcomes the opportunity to comment on the Building Amendment Bill.

The reasons for making this submission are that HPA promotes the preservation of historic places in Aotearoa New Zealand. HPA also has an interest to promote the education of the public in the appreciation of heritage values. HPA is a key stakeholder in the consultation process and answerable to its affiliated regional societies and associated membership.

HPA has reviewed the Building Amendment Bill and considered the impact the proposed amendments will make on heritage buildings.

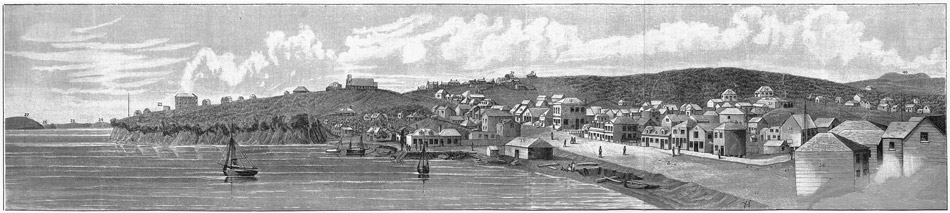

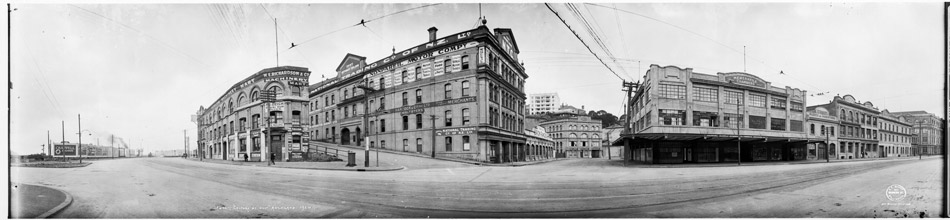

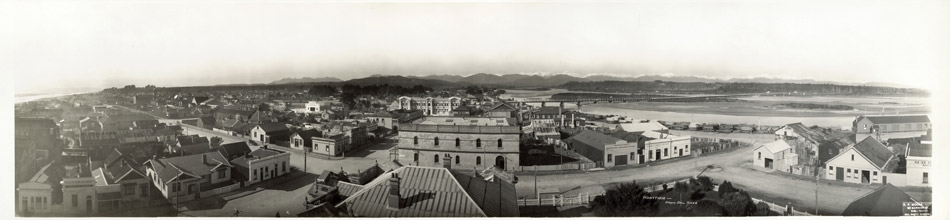

HPA has a particular interest in the subject of this Bill, for the merits of the sustainable urban quality and distinctive character of New Zealand cities and towns.

Too often demolition of heritage building post disaster is seen as the only solution to public protection. Other countries deal with heritage buildings in a more considered manner. Italy for example have teams of trained experts that will shore up damaged heritage buildings post natural disasters. This enables heritage and structural assessments to be made on a more considered basis.

It will be important that New Zealand trains people who are competent to make decisions with respect to heritage buildings and structures following an emergency situation and can either be, or assist the “responsible person” who is exercising their powers in the designated area under the proposed revisions to the Building Act.

HPA is generally supportive of the proposals in the consultation document as they try to strike a balance between the risk to life, the built historical environment and public / private rights during the difficult periods associated with managing buildings after an emergency and to provide for investigating building failures.

General comments:

In New Zealand under the current heritage management and protection systems, not all heritage is listed with Heritage New Zealand Pouhere Taonga (HNZPT). Much of the country’s heritage is scheduled under each of the various district plans.

For the purposes of this amendment, consideration needs to be given to acknowledging the significance of heritage listed buildings in the heritage lists of district plans, as required under the RMA, as well as those on the HNZPT National Historic Landmarks list and the HNZPT category one list.

In most cities there are examples of significant heritage buildings scheduled in the local territorial authority (TA) plans that are not listed by HNZPT or have been listed as Category II items. This may be due to HNZPT budget constraints, lack of information when buildings were initially assessed. (more…)