“To us and many submitters, the cure for earthquake-prone buildings could destroy our provincial towns in order to save them. "

“To us and many submitters, the cure for earthquake-prone buildings could destroy our provincial towns in order to save them. "

“It is hard to disagree with the Property Council of New Zealand, which believes the Bill could work, but only if earthquake strengthening is made tax deductible, qualifying for depreciation."

The Media Release is as follows:

Cracks appear in the Earthquake-prone Buildings Bill

The potential dragnet of the Building (Earthquake-prone Buildings) Amendment Bill is so vast, both Federated Farmers and Rural Women NZ believe it could become a sequel to the Psychoactive Substances Bill, recently amended by Parliament due to public concerns.

“There’s a rainbow coalition of submitters telling Parliament that the Building (Earthquake-prone Buildings) Amendment Bill needs reworking,” says Anders Crofoot, Federated Farmers building spokesperson.

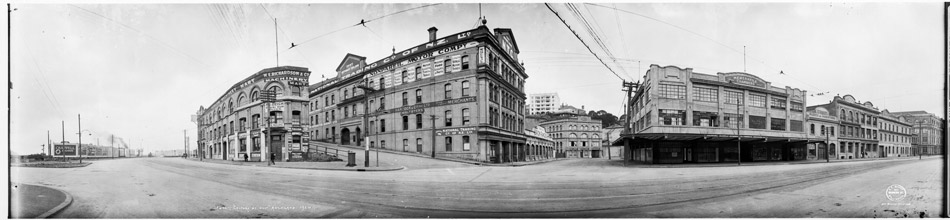

“The proposed Bill requires all councils to assess buildings and requires owners to demolish or strengthen any earthquake-prone structures within 15 years.

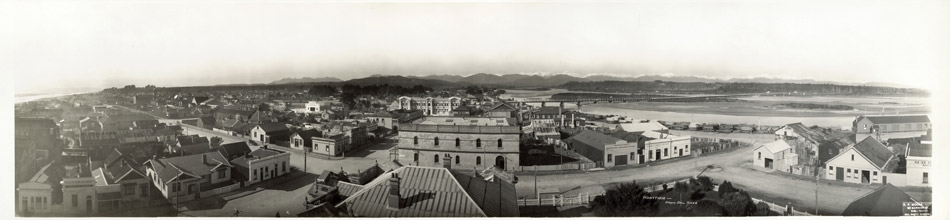

“To us and many submitters, the cure for earthquake-prone buildings could destroy our provincial towns in order to save them.

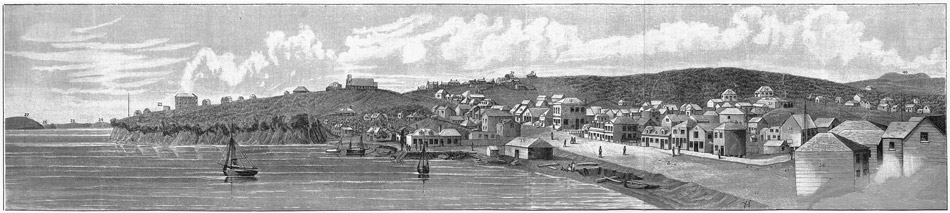

“While seismic strengthening in high-rise Wellington and Auckland makes sense, that urban profile isn’t Masterton or Gore. While there are earthquake risks they’re not exactly the same,” Mr Crofoot added.

Rural Women NZ was likewise concerned by the Bill’s potential effect.

“Rural Women NZ endorses Federated Farmers submission,” says Noeline Holt, its Executive Director.

“Our provincial centres cannot match the massive square metre rents found in Newmarket or on Lambton Quay yet the seismic cost is the same.

“From looking at the submissions, we hope the Select Committee will recommend the Bill be amended to consider its real economic and social implications, as well as focussing on those things that’ll make a real impact on safety,” Ms Holt said

Federated Farmers agrees with Local Government New Zealand’s submission and wants the Bill to prioritise those communities at the greatest risk.

“Many of the safety objectives can be achieved by targeting buildings and building parts most likely to fail in earthquake prone areas. Even then, low rise buildings, so typical in our provincial towns do not seem to suffer from catastrophic failure,” Mr Crofoot continued.

“In other parts of the country, a focus on parapets, verandas and removing at risk items could greatly boost safety at the least social and financial cost.

“It is not as if rural and provincial New Zealand has not experienced earthquakes. Where I farm, Castlepoint, in Wararapa, we had a 6.2 quake only in 20 January but the damage related mostly to wine.

“Need I mention the Seddon, Darfield, Gisborne or Edgecumbe quakes? If the Bill proceeds unchanged we could see thriving towns turned into ghost towns.

“If the costs far exceed any sensible return building owners may board up or demolish. While that aids freedom squatters and clandestine labs it will not benefit those of us who live there.

“It is hard to disagree with the Property Council of New Zealand, which believes the Bill could work, but only if earthquake strengthening is made tax deductible, qualifying for depreciation.

“Seismic work does not add a cent to the value of a building, it only returns the building to the value it once had,” Mr Crofoot concluded.

Federated Farmers submission can be read here. http://www.fedfarm.org.nz/files/2014-04-14%20-%20Earthquake%20Prone%20Buildings%20Subsmission.pdf

For further information contact:

Anders Crofoot, Federated Farmers Buildings spokesperson, 027 426 5324, 06 372 6465

Noeline Holt, Rural Women NZ Executive Officer, 021 868 608

Comments are closed.