Tax changes for earthquake-prone buildings wins support

Historic Places Aotearoa applauds the tax working group’s proposed changes to tax policy relating to earthquake strengthening of buildings.

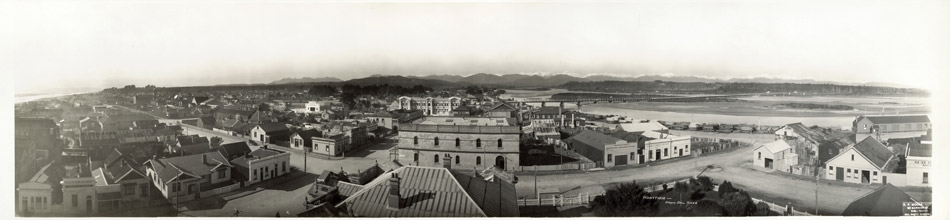

HPA President James Blackburne supports the initiative to review or change the tax policy as it would benefit owners of earthquake-prone buildings, many of which are an integral part of New Zealand’s heritage .

“One option being considered is to restore building depreciation for seismic strengthening work on commercial, industrial and multi-unit residential buildings.

“Reinstating building depreciation deductions or allowing owners to claim strengthening as a repair and maintenance cost will benefit owners of earthquake-prone buildings.

”While the devil will be in the detail as to whether it will be implemented and in what form, the underlying concept of tax relief will have a positive effect because it will reduce the cost to building owners of strengthening buildings and may mean that strengthening is considered rather than demolition being seen as the only viable option.

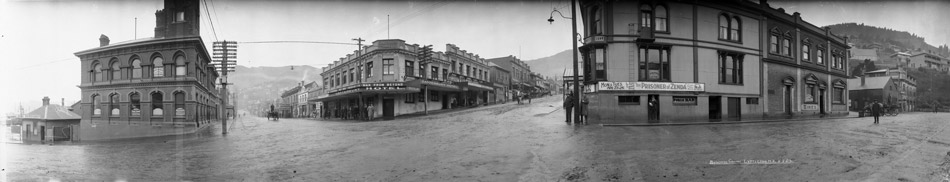

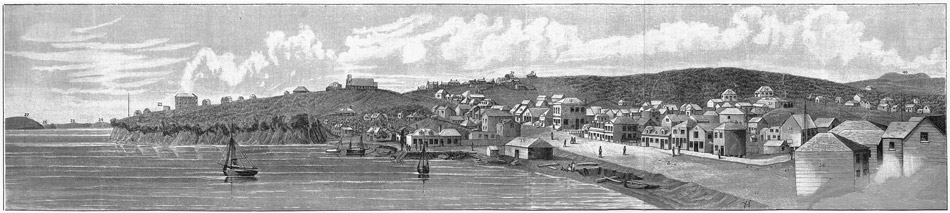

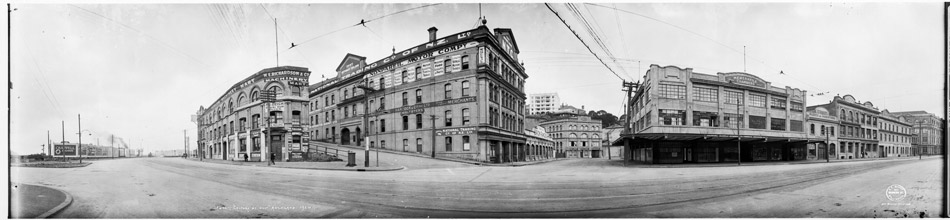

“We believe this will have a positive effect on the retention rate of heritage buildings throughout New Zealand, and in particular provincial New Zealand, where many main streets are lined with unreinforced masonry heritage buildings.”

Mr Blackburne said the proposed tax change, in addition to the continuing with Heritage EQUIP grants, would be of benefit to owners.

Heritage EQUIP offers two grants for seismic strengthening projects – Upgrade Works Grants to a maximum of $400,000 or, for regional building owners, up to two thirds of seismic upgrade works; and Professional Advice Grants to a maximum of $50,000 per project or, for regional building owners, up to two thirds of professional advice costs.

The new professional advice grants are aimed specifically at regional building owners outside the three main centres.

James Blackburne

President Historic Places Aotearoa

P 0274818093

c/o P O Box 1241

GISBORNE 4040

Comments are closed.