The Historic Places Aotearoa submission to the Local Government & Environment Committee on the Building (Earthquake-prone Buildings) Amendment Bill is as follows:

The Historic Places Aotearoa submission to the Local Government & Environment Committee on the Building (Earthquake-prone Buildings) Amendment Bill is as follows:

Patron: Dame Anne Salmond, DBR, FRSNZ, FBA

2013 New Zealander of the Year

Chair of the Local Government & Environment Committee,

NZ Government,

Parliament Buildings,

Wellington.

Building (Earthquake-prone Buildings) Amendment Bill

Local Government and Environment Select Committee

17 April 2014

Introduction

This submission is made by Historic Places Aotearoa Inc. (HPA) which

welcomes the opportunity to comment on the Building (Earthquake-prone

Buildings) (EPB) Amendment Bill (the Bill).

The reasons for making this submission are that HPA promotes the

preservation of historic places in Aotearoa New Zealand. HPA also has

an interest to promote the education of the public in the appreciation of

heritage values. HPA is a key stakeholder in the consultation process and

answerable to its affiliated regional societies and membership.

HPA has reviewed this Bill and considered the impact the proposed

amendments will make on heritage buildings.

HPA has a particular interest in the subject of this Bill, for the merits

of the sustainable urban quality and distinctive character of New

Zealand cities and towns. Making those policies workable requires

appropriate resourcing, especially of the right quantity and level of

engineering and related professional skills. There are public-good

benefits which justify public investment side-by-side with the costs

and benefits for private and corporate owners of heritage buildings.

HPA is generally supportive of the requirements of the Bill. It believes it

strikes an appropriate balance between protecting people from possible

harm and managing the costs associated with strengthening whilst at the

same time, recognizing the need to preserve New Zealand’s heritage. A

national consistent approach is preferable to the variety of approaches

which prevail under the current system. The policy shift to greater

guidance from central government should assist those Territorial

Authorities (TAs) with more limited access to expertise, resources and

information.

The aim of the Bill is to improve the system for managing Earthquake

Prone Buildings (EPB). It notes that the current system is not achieving

an acceptable level of risk and that many EPB are not being dealt with in

a timely and cost effective manner.

The amendments to the Bill include:

• Requiring TAs to undertake seismic assessment of non residential

buildings within 5 years using a nationally consistent system based

on a Ministry of Business, Innovation and Employment (MBIE)

methodology. (Includes residential buildings if greater than two

stories and greater than 3 residential units.)

• MBIE to provide a register of seismic capacity of buildings.

• Clarifying that the current seismic threshold for defining EPB

applies to parts of buildings as well as whole buildings.

• Clarifying that the level of work required for earthquakeprone

buildings is only such that the building, or the affected

part, is no longer earthquake-prone.

• Requiring work on existing earthquake-prone buildings to be

undertaken within a single national timeframe—within 20

years of the legislation taking effect (i.e. assessment by territorial

authorities within 5 years and work completed within 15 years),

• Providing for work on priority buildings (to be defined in

regulations) to be prioritised: (This covers where buildings could

impede transport on routes of strategic importance and buildings

required for public safety.

• Providing for exemptions from requirements to undertake

work for certain buildings:

• Providing that owners of buildings that are Category 1 historic

places under the Historic Places Act 1993 may apply to the

relevant territorial authority for an extension of up to 10 years

to complete the work, and the owners must manage risk if an

extension is granted:

• Providing for a much greater role for central government, including

in relation to monitoring system performance, and providing

direction and guidance. (Relates to administration but does not

indicate a step up in leadership, encouragement or incentives to

strengthen EPB.)

• The current strengthening requirements for EPB will not change

from the existing 33% of the New Building Standard (NBS).

• Owners who’ve already had a seismic assessment under the current

regime and have been given less than 15 years will have to work to

the timeframe they have been given.

HPA particularly endorses the following changes:

• the requirement for Territorial Authorities to undertake a seismic

capacity assessment within 5 years for all non-residential and multi-unit or

multi-storey residential buildings;

• provision of a publicly searchable register of seismic capacity to be

held by MBIE;

• setting a national time frame of 20 years for completion of work (5

years for assessment and 15 years for compliance) with provision for

exceptions for some heritage buildings, low risk buildings and priority

building,(to be defined by regulation) ;

• exempting earthquake strengthening work from triggering the

disability access and fire access upgrades (subject to guidelines to be

developed by MBIE);

• providing that if a building has already had an assessment that is

recognised under the new system and the owner has been given more than

15 years to strengthen that building, they will now only have 15 years to

strengthen.

HPA welcomes clarification that:

• the definition of earthquake-prone building can apply to parts of

buildings

• that the level of work required for earthquake-prone buildings is only

such that the building, or the affected part, is no longer earthquake-prone:

• and that if a building will have its ultimate capacity exceeded in a

moderate earthquake (as defined in regulations the building is earthquake

prone only if there is a likelihood of injury, death, or damage being caused

if the building were to collapse (rather than a likelihood that the building

would collapse).

Specific recommendations

Section 133AC

HPA fully supports the provision to require a TA to prioritise assessment

of priority buildings and to allow for a shortened time frame for

compliance. The effectiveness of this provision will depend on the

regulations to be made under section 104C and the methodology to be set

in accordance with section133AG. HPA believes that the definition of

priority building must include features such as unsecured gables, parapets

and walls facing public spaces on URM buildings. Although the

definition of an earthquake prone building already takes account of

ground conditions where particularly high risk geotechnical conditions

can be identified this might also trigger priority assessment.

Section 133AT

HPA notes that the power to grant an extension of time for heritage

buildings set out in this section applies only to Category 1 buildings,

though the definition of heritage building in the Bill includes both

Category 1 and 2 buildings under the NZHPT Act. The legislative impact

assessment has also been made on the basis that extension can apply to

category 1 and 2 buildings. HPA submits that the Bill should be amended

to allow for an application for extension of time by owners of both

Category 1 and category 2 buildings even though many heritage buildings

would also be likely to qualify for exemption under 133AS. We note that

the impact assessment raises the concern that allowing an extension for

heritage buildings could lead to demolition by neglect. HPA shares this

concern and feels that in general it is desirable to bring all heritage

buildings up to strength as soon as possible, nevertheless we recognise

that unless heritage building owners have recourse to financial assistance

or other forms of incentive, many face real financial hurdles in bringing

buildings up to strength. If the section were broadened to include both

Category 1 and 2 buildings it would allow the TA discretion to extend

time for a building which is ranked more highly in the District Plan than

on the Heritage New Zealand Register. Concern that broadening this

power would lead to its overuse could be addressed by including a new

provision enabling regulations to be made setting out criteria to guide

TAs in the exercise of this discretion.

Greater clarity is also needed in the situation where a heritage building

might fall within the definition of a priority building. The Bill recognises

this possibility in proposed section 133A0(4) but the wording for the

completion deadline is unnecessarily complicated. It is the view of HPA,

that if a heritage building is also a priority building then the deadline for a

priority buildings should apply.

Section 133AW

HPC is concerned that the Bill provides for unnecessary costs on TAs and

therefore ratepayers where an owner has failed to comply with a deadline.

It is important that the TA is able to carry out the seismic work itself in

this case but the requirement to obtain authorisation from the District

Court seems unnecessarily burdensome. The TA should be permitted to

act after reasonable notice shifting the burden to the owner to apply to the

Court if they object. If this change were adopted the minimum period of

notice should be increased from 10 days. Alternatively the Bill should be

amended to make it clear that the TA can recover not only the cost of the

work but also the cost of applying to the Court.

General Comments

HPA submits that the extended deadline for completing seismic work

under cl 133AO and ability to apply for a further extension under cl

133AT should apply to all heritage buildings as defined under cl 6 of the

Bill, rather than confined to Category 1 heritage buildings.

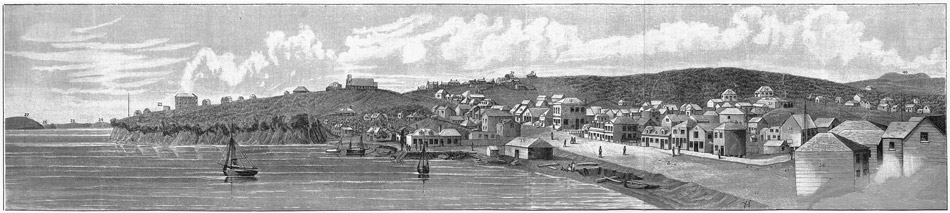

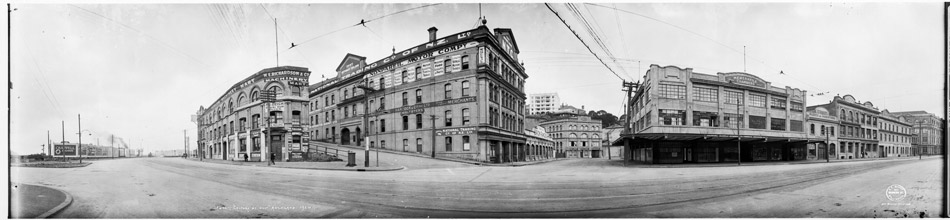

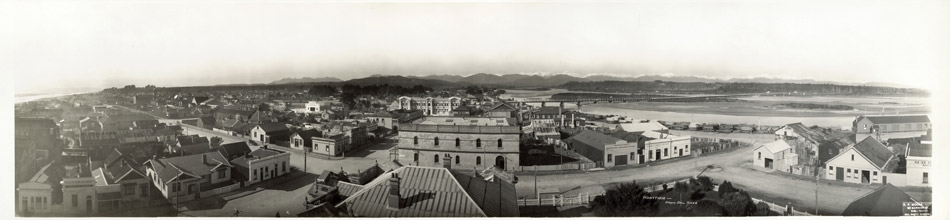

There are approximately 15,000 - 20,000 buildings that are potentially

earthquake prone buildings in New Zealand. The heritage buildings

currently registered either as category 1 or category 2 heritage buildings

represent a very small proportion of that total. However, the loss of such

buildings, if heritage building owners are not given some ability to

manage the costs of earthquake strengthening, would represent a

significant permanent alteration of our city and townscapes to the

detriment of our cultural identity.

Clause 6 of the Bill defines "heritage building" as a building registered as

a historic place under Part 2 of the Historic Places Act 1993. This

definition includes both category 1 and category 2 heritage buildings. To

be registered, a building must be either a place of special and outstanding

historical or cultural heritage significance or value (category 1) or a place

of historical or cultural heritage significance or value (category 2). This

categorisation is carried over into the New Zealand Heritage List in the

Heritage New Zealand Pouhere Taonga Bill, which is currently before

Parliament.

HPA submits that category 1 buildings represent a very small proportion

of heritage buildings in New Zealand. Given that category 2 buildings

represent places of historical or cultural heritage significance and value,

the owners of these buildings should also be given both the extended

deadline for completing seismic work under cl 133AO as well as the

ability to apply for a further extension under cl 133AT. Cl 133AT(4)

adequately addresses any safety concerns by requiring the building owner

to take all reasonably practicable steps to manage any risks associated

with the building being earthquake prone. Accordingly, HPA submit that

the definition of "heritage building" should apply to cls 133AO and

133AT, rather than category 1 buildings only.

Funding the reforms.

The Bill seems to assume that the cost of the seismic assessment will be

borne by the TA. Because the definition of earthquake proneness takes

into account locality, TAs in areas facing great earthquake risk will face

higher costs than others. In high-risk rural regions the number of

buildings to be assessed may be fewer but the rating base will also be less.

Consideration needs to be given within the Bill to providing for full or

partial cost recovery from building owners. Policy consideration also

needs to be given to setting up a fund to assist TAs facing particular

hardship in carrying out their responsibilities resulting from the proposed

changes. Even if changes are made to allow cost recovery, some will

face real difficulties with the up-front costs of the assessment before they

can recover from the owners.

HPA wishes to appear before the Committee to speak to their submission.

Contact:

Dr. Anna Crighton

President

Historic Places Aotearoa

P O Box 693

Christchurch 8041

Comments are closed.