Accelerate heritage building retention by accelerating depreciation and expenses. Peter Dowell, a heritage building developer, makes the case for a change in Government tax policy.

The following is a copy of a letter sent by Peter Dowell (Heritage Building Developer and Historic Places Aotearoa Board Member) where he outlines the arguments for changes to the tax code to aid the retention of our built heritage.

Comment:

We thank Peter Dowell for making this letter available. We think it is important that Heritage Advocates/Activists have an understanding of the issues being faced by heritage building owners. In email correspondence with us, Peter states he has had no formal response to his letter. (This includes the New Zealand Historic Places Trust.)

We will keep you posted on any developments.

Letter follows ...

David Hopkins

Senior Advisor Building Standards

Level 6, 86 Customhouse Quay

Wellington

Wednesday, 11th August 2010

Dear David,

Earthquake Prone Building (EQPB) Policies for Heritage Buildings – Depreciation Issues

The attached letter has been sent to the Ministers of the following Government Departments

- Minister of Culture & Heritage

- Minister of Local Government Authorities

- Minister of Revenue

- Minister of Housing

Executive Summary

- We are concerned that the current depreciation and regulatory regime does not encourage owners of heritage properties to undertake upgrading and earthquake strengthening to retain heritage values.

- Indeed, with the recently introduced depreciation amendments, many of the buildings considered to be of value to the cityscape and the sense of place, particularly in Wellington CBD, will be left to deteriorate. This will result in some owners choosing to demolish, or the resultant outcome being demolition, due to neglect, rather than strengthen or maintain the building.

- There is no incentive at present for owners of heritage property to earthquake strengthen their buildings. The reverse is the case as owners who do choose, and are financially able, to do this work are effectively double taxed in that they are rated on an improved value and can now no longer claim any depreciation on the work undertaken.

- Quotable Valuation doesn’t include the likely amount to strengthen and earthquake prone building in their valuation process. If this was to be done it would assist the Department of Building & Housing in quantifying the likely cost to building owners throughout each Territorial Authority & New Zealand. This needs to be done by way of a separate line “EQPB” on the rating notice.

- New Zealand has approximately 15,000 heritage and earthquake prone properties; Wellington has 3,800.

- To encourage retention of the cityscape and heritage, we recommend allowing at the very least, depreciation for heritage earthquake prone buildings and at best, the earthquake strengthening be allowed as a tax expense/deductible item.

- Given the new policy that all buildings with greater than a 50 year life span are no longer eligible for depreciation, it could be argued that the local authorities with the IEP process have identified a set of buildings that have a life of less than 50 years i.e. these have to be strengthened within a 20 year time frame otherwise will have to be demolished.

Background

- With regard to EQPB and especially Heritage buildings, we believe that insufficient recognition is given to the cost to the owner and by definition, occupiers, to retain the landmarks of the country’s (and in our case, Wellington’s city) built heritage, especially when compared to other owners who have the right to demolish if desired.

- Given the current economic environment, requiring strengthening to the level desired under the revised Building Act (2004), Government needs to investigate more innovative policies that could assist owners in making these structures safer for public utility and allow retention of our sense of place.

- The Spargo Report (Built Heritage Management in Wellington City Graham Spargo Partnerships November 2007) highlights financial and other means to appropriately manage built heritage. The social benefit is estimated at $39 million, relating to tourism visitor instrumental value to built heritage for Wellington (page 13). It concludes that heritage buildings are worth investing in for optimal benefit for the local economy. In addition, the social benefits for future generations are not easily quantifiable but could be argued as being priceless e.g. rejuvenation of Chews Lane.

- Donovan D Rypkema in his article Dollars & Sense of Historic Preservation (American National Trust for Historic Preservation) debates the issue of who benefits from and who pays for preservation of historic buildings. He outlines the most frequent scenario as being when the cost of rehabilitating an historic building exceeds the economic value of that investment. In the US, to address this, there are a multitude of investment incentives to attract capital:

- Federal rehabilitation tax credits (Central government tax depreciation)

- Local property tax abatement (ie rates relief/deferment)

- Low interest loan pools

- Public grants

- Revolving funds

- Currently owners in New Zealand (including Wellington) are not incentivised in any way, shape or form for investing in, or protecting historical or EQP buildings.

- Occupiers do not receive any tax credits or incentives for choosing to rent historic sites.

- There are some Territorial Authorities providing limited funds via Heritage Grants and rates relief (as one offs) but these represent a drop in the bucket compared to the total cost to upgrade the potentially 15,000 earthquake prone buildings.

- EQPB owners are additionally penalised:

- In their insurance premiums, especially in the current environment as the insurance industry is now aware (due to the EQPB policies) of which buildings the premium can be loaded. This makes it very difficult, and expensive, to insure individual buildings for full replacement. In addition, issues have arisen from the previous Gisborne earthquake – property owners are not covered by their insurers for buildings that have been notified as requiring strengthening.

- in the current recessionary environment, banks are declining applications for funding for earthquake strengthening

- However, the public and cityscape benefit from the preservation of the streetscape, as has been clearly recognised in numerous studies.

- So how does the owner benefit if not able to generate an economic return on its investment?

Where to from here?

- We believe that the government needs to grasp the opportunity granted by the earthquake issues to be innovative in its methods of incentivising heritage and EQP building owners and occupiers: i.e. to encourage investors to strengthen whilst retaining historic features of buildings.

- In doing so, it will also provide additional long term revenue, directly through increased rates and taxes, and indirectly through increased employment and tourist attractively.

- The most logical answer is to provide accelerated depreciation/expensing for heritage and EQP buildings and/or structures, so as to provide a non-cash, but effective, mechanism via the tax system to assist in preservation and maintenance.

- The current depreciation revision provides for depreciation allowances for buildings with a less than 50 year life. Most EQP buildings will therefore be able to claim the depreciation until such time as the structure is strengthened. This acts as a disincentive to strengthen, which was obviously not the intent of the new policy.

- The ideal solution is to allow EQP building owners to expense their strengthening costs in the year of completion as the long term benefits from a tax collection and rates perspective by far outweigh the one off hit.

- We have included an actual situation displaying the payback for central and local government revenue in Appendix One.

Conclusion

We consider that government should revisit its depreciation policy for strengthening of EQP heritage buildings. We will be pleased to discuss further in person if required.

We thank you for your consideration and look forward to your response/s.

Yours sincerely

Peter Dowell

Director – Heritage Property Management Ltd

- Appendix 1 - EQPB – Albermarle Building, Wellington

- Appendix 2 - White Hart Building, New Plymouth.

- Appendix 3 - Property Council of Australia – “Making Investment in Heritage Buildings More Attractive” – Submission to Heritage Act Review Panel NSW 2007.

Appendix One - EQPB

Case Study – Albermarle – Earthquake Prone Building Requiring Strengthening.

Case Study – Albermarle – Earthquake Prone Building Requiring Strengthening.

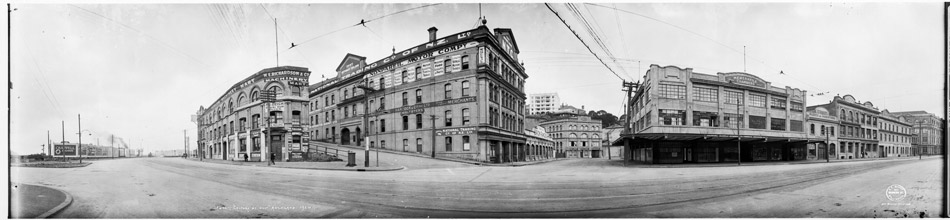

The Albermarle Building, located at 59 Ghuznee St, Wellington, is a Category II Heritage Building. It requires full earthquake strengthening to bring it up to current code requirements.

The WCC has sent a notice to the owner requesting information as to the owner’s intention: is it to strengthen or demolish the building within the next 2 years? Obviously given that it is a Category II building demolition is NOT an option.

Current Situation

Vacant Building generating no income & paying minimal rates - $5,400 p.a.

| Building Value | $1.60 M |

| Cost of Restoration | $0.40 M |

| Fitout/Clean shell | $1.00M |

| Total Cost | $3.00 M |

If able to expense Earthquake Strengthening, the tax benefit to the owner is $120,000 (one off) based on 30% of expenditure

On completion for Earthquake Strengthening & refurbishment

| Increased Gross Income for owner | $350,000 |

| Operating Expenses (20% GI) | ($70,000) |

| Interest based on 50% loan @ 6% | ($137,000) |

| Net Income | $143,000 |

- Rates payable approximately - benefit to Territorial Authority $35k p.a

- Tax payable approximately - benefit to Government $43k p.a

- Creates additional jobs(construction as well as ongoing)

- Adds to streetscape

Appendix Two - Heritage

Case Study – White Hart Hotel – New Plymouth – Heritage (Wooden) Building requiring Restoration.

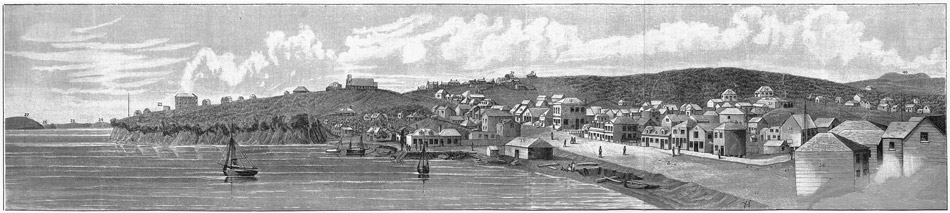

The White Hart Hotel is Cat I Heritage Building that forms an important part of the New Plymouth Streetscape. The Building has suffered greatly from the elements of time and the current owners have been trying to work through numerous proposals (over the last 8 years) to restore the Heritage architecture of the building. Given the sheer size of the building and costs involved in the restoration project it has proven difficult to be able to make the numbers work and produce an economic return for its owners.

The White Hart Hotel is Cat I Heritage Building that forms an important part of the New Plymouth Streetscape. The Building has suffered greatly from the elements of time and the current owners have been trying to work through numerous proposals (over the last 8 years) to restore the Heritage architecture of the building. Given the sheer size of the building and costs involved in the restoration project it has proven difficult to be able to make the numbers work and produce an economic return for its owners.

Current Situation

Vacant Building generating no income, with a annual holding cost of some $30k p.a. Rates $5,500 p.a

| Building Value | $0.70 M |

| Cost of Restoration | $0.50 M |

| Fitout/Clean shell | $1.00M |

| Total Cost | $2.20M |

If able to expense the restoration costs to retain the Heritage values/fabric, the tax benefit to the owner is $150,000 (one off) based on 30% of expenditure. This could replace the Heritage Grant provided by the NZHPT.

On completion of the Restoration work and additional building works

| Increased Gross Income for owner | $150k |

| Operating Expenses (20% GI) | $30k |

| Interest based on 50% loan @ 6% | $65k |

| Net Income | $55k Net return 2.5% - uneconomic |

- Rates payable approximately - benefit to Territorial Authority $ Nil p.a

- Tax payable approximately - benefit to Government $ 17k p.a

- The economics of restoring the White Hart don’t stack up, but the local community is lucky that the building is owned by a group of passionate people who want to bring this iconic building back to its former glory to benefit the City of New Plymouth and future generations.