The "Harcourt building has a future" Opinion /Article by Bruce Chapman (Chief Executive of the NZHPT) was published in The Dominion Post.

The "Harcourt building has a future" Opinion /Article by Bruce Chapman (Chief Executive of the NZHPT) was published in The Dominion Post.

The NZHPT has released the text of the article in a Media Release.

The Media Release is as follows:

11 October 2013

Harcourt building has a future

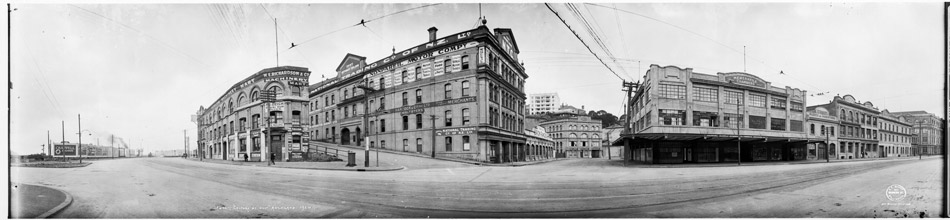

Amidst reactions to the decision of the Environment Court to refuse consent to demolish the Harcourt Building, including the op-ed piece from the owner’s business partner, Mr Corleison (Dominion Post 10 October) it is worth reflecting on some of the facts of this case and also on the reasons for the Court’s decision.

The Harcourt building was listed for protection in the District Plan in 1994, well before it was acquired by the current owner. The standards for earthquake strengthening and the provisions of the Building Act requiring retrospective strengthening have also not changed since 1999 when the current owner acquired the building.

It can be presumed that the owner undertook due diligence prior to purchase and if so the price should have reflected most if not all of any limitation in value or risk associated with these factors.

Also relevant is the fact that the adjoining HSBC building which was not built until 2002 has the same owner. In this respect the evidence established that to maximise its floor area, the younger and taller HSBC building was built with a seismic gap that is not sufficient to prevent it from “pounding” against the more rigid Harcourt building in a moderate earthquake. The cost of increasing the seismic gap between buildings requires reducing the floor area and therefore rental returns from the Harcourt building. Furthermore the HSBC building was constructed to maximise its net lettable floor area by infilling the atrium of the Harcourt Building with a stair and lift well, thereby reducing the Harcourt building’s options for use and its rental value even further.

All of the evidence of the parties to the hearing supported the view that the Harcourt building has very significant heritage values, and that it requires and is capable of strengthening.

The case therefore turned on the consideration of options and the economic viability of those options. The owner produced evidence as to the costs of strengthening and the likely returns to attempt to demonstrate that strengthening was uneconomic and that demolition was the only option. In doing so, the owner’s evidence expected the Court to accept that all of the costs of seismic strengthening could be attributed to the Harcourt building while ignoring the significant benefits accruing to the HSBC building. In spite of significant but less profitable prices offered by prospective purchasers, the owner also admitted that he would only accept something closer to the higher value he could obtain due to his ownership of the adjoining HSBC building.

In its decision to decline the appeal, the Court concluded amongst other matters, that while other adaptive re-uses had been considered, the Court was not satisfied that all reasonable alternatives had been explored other than with a handicap set by an insistence on a rigidly set bottom line figure being demanded for the land and buildings as they are.

Environment Court cases such as this do not set a precedent in that the Court considers the facts of each case on their merits, against the applicable law and plan rules. That said, much can be learned from this case. It is essential that commercial property owners undertake pre-purchase due diligence with respect to District Plan rules and earthquake strengthening requirements. When resource consent applications are made for demolition of protected heritage buildings genuine attempts must be made to evaluate all available options for retention with costs and benefits appropriately assigned.

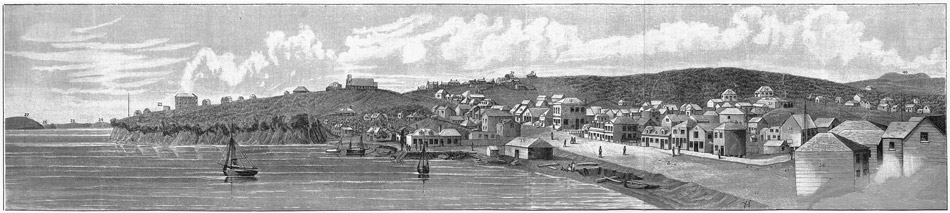

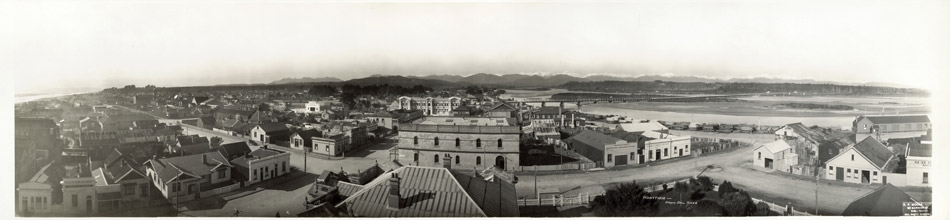

In considering cases such as this the NZHPT recognises that public safety is paramount and that where buildings with significant heritage values are considered earthquake prone, that they are either strengthened or demolished. Our experience working both with building owners around New Zealand, and managing the 48 heritage properties in our care, means we know that strengthening and adaptive re-use is possible in the vast majority of cases. We work constructively with owners to help them find a solution to the very real difficulties that many of them face. Wellington has many examples where investment in strengthening has worked for owners, resulting in tenanted buildings that continue to enhance the heritage value and character of the city. Privately owned examples include Shed 22 and the former DIC, BNZ, Whitcoulls, Odlins, Wellington Free Ambulance, Morgan, and Huddart Parker buildings to name a few.

There are only around 200 commercial heritage buildings nationwide in private ownership that are registered as Category 1. If they are to survive to be enjoyed by future generations they will need to be strengthened to withstand at least moderate earthquakes and retain sufficient structural integrity as to be capable of repair. In this respect there is no conflict between the desire for heritage conservation and public safety.

There will be cases where the economics of retention do not stack up and the owner is genuinely facing hardship, particularly where retrospective limitations on use or additional compliance costs did not apply at the time of purchase. In situations where demolition is considered the only viable option to ensure public safety, communities need the opportunity to consider whether some form of assistance to owners is necessary to swing the balance in favour of strengthening.

Increasingly assistance is on offer from local Councils and these are being actively promoted by the NZHPT. A case can be also made for deductibility of strengthening costs for heritage buildings on the basis of the public good values their continued existence provides. Such an approach would recognise that there are cases where it is inappropriate to socialise the benefits of regulation, while privatising all of the costs. Clearly however, the Harcourt building was not such a case.

Bruce Chapman, Chief Executive of the New Zealand Historic Places Trust (NZHPT)

Comments are closed.