Historic Places Aotearoa Welcomes Government Tax Changes

Historic Places Aotearoa (HPA) applauds the Government for including depreciation of earthquake strengthening in its COVID-19 stimulation packages, and providing real incentives for commercial heritage building owners.

HPA President James Blackburne said this initiative would be welcomed by commercial heritage building owners facing the burden of earthquake strengthening.

"The depreciation rate of two percent diminishing value is a good first step. We are looking forward to the Government's new heritage initiatives.

"Work on heritage buildings can be quickly made ‘shovel ready’ and this applies to strengthening. This meets the Government’s intention in their Stimulus Bills.”

Mr Blackburne commended Minister Grant Robertson for acting on the Cullen Tax Working Group's recommendation, and the Opposition's Paul Goldsmith for supporting the Bill.

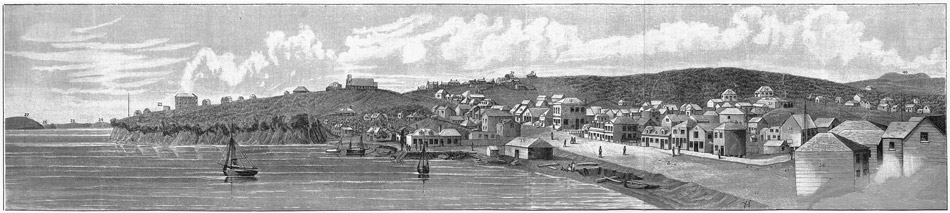

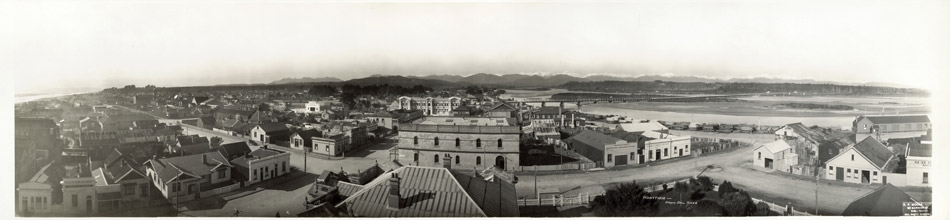

Whanganui District Council councillor Helen Craig welcomed the changes, which the council and local heritage organisations had lobbied long and hard for, due to the city’s significant heritage town centre.

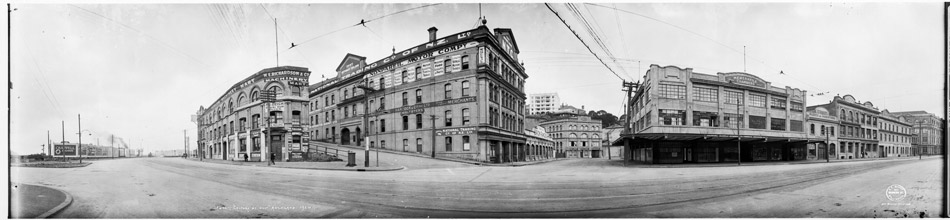

“A full range of incentives are needed to support heritage building redevelopment due to high costs versus the value of buildings, especially in provincial New Zealand.

“New Zealanders value their heritage but it's rapidly deteriorating and at risk due to age, changing demand and use for inner city spaces, and earthquake strengthening requirements."

Heritage restoration advocate Dame Anna Crighton concurred.

"As chair of a heritage trust restoring two commercial heritage buildings, I can state the changes to depreciation is a prudent and worthwhile practical help.

"Depreciated strengthening supports the ‘adaptive reuse’ of heritage buildings. We can look forward to seeing vibrant heritage buildings in our cities and provincial main streets."

Background:

The Government now allows commercial building owners, including heritage building owners, to depreciate the capital cost of earthquake strengthening by 2 percent in diminishing value.

In addition, this will be an incentive for Heritage Building "Adaptive Reuse" Projects where the original use is changed ie, a government building interior is converted to lawyers offices with full IT support.

(The change was made in Section 39 of the COVID-19 Response (Taxation and Social Assistance Urgent Measures) Act 2020 Public Act 2020 No 8. Date of Ascent March 2020.)

Media Contact:

James Blackburne

President Historic Places Aotearoa

Moblile: 027 481 8093

Comments are closed.